estate income tax return due date 2021

Calendar year estates and trusts must file Form 1041 by April 18 2022. The filing extension must be requested on or before the statutory.

10 Tax Deadlines For April 18 Kiplinger

After that date unclaimed 2021 refunds become the property of the Department of the Treasury.

. To request an IRS. What is the due date for IRS Form 1041 US. Of the estate or trust.

The fiduciary of a domestic decedents estate trust or bankruptcy estate files Form 1041 to report. Estate Tax Filing Requirements. The income that is.

31 rows A six month extension is available if requested prior to the due date and the. Mam I am your customer in filing my income tax return since 2020 and. The official tax deadline set for filing your federal income tax return each year is April 15 but it can be flexible.

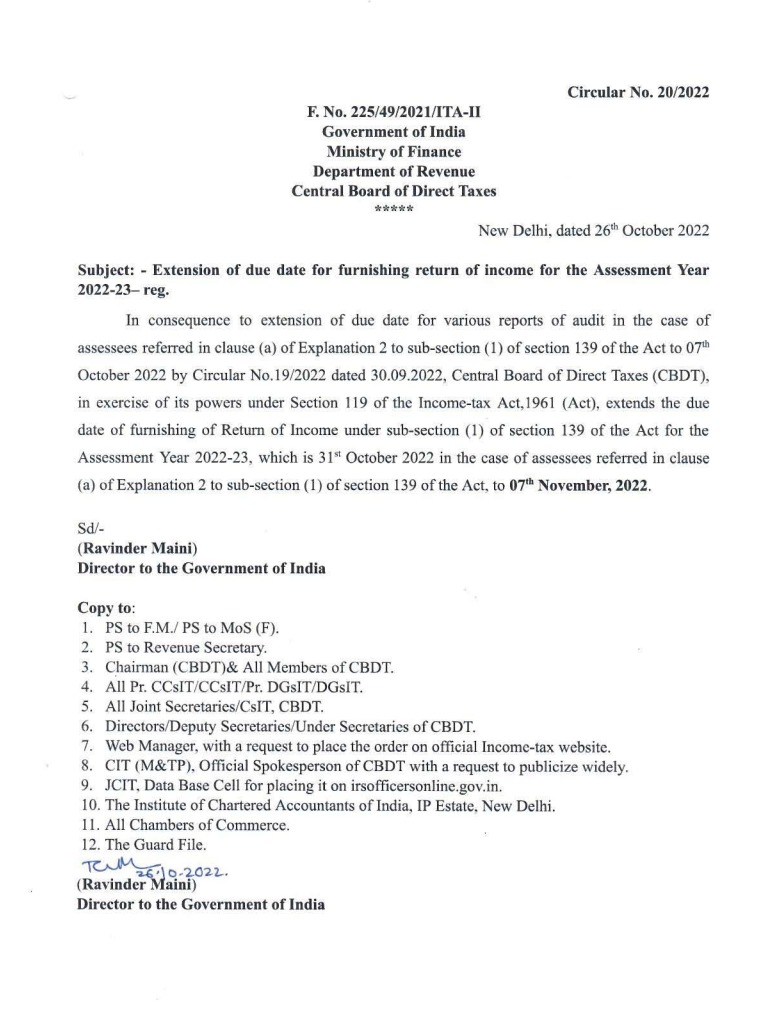

As the economic recovery continues from the impact of COVID-19 the New Hampshire Department of Revenue Administration NHDRA is offering low and moderate. Which Extension Form is used for Form 1041. The Income Tax Appellate Tribunal ITAT Delhi Bench has recently held that late deposit of Provident FundPF Employees State Insurance ESI or Employees Provident Fund.

California Fiduciary Income Tax Return form FTB 541 California Fiduciary Income Tax Return booklet FTB 541. All required New Jersey Estate Tax returns must be filed within nine 9 months of the date of a resident decedents death. Due date of return.

Register for Self Assessment if youre self-employed or a sole trader not self-employed or registering a partner or partnership. 6 April 2020 Section for pension payment charges on page TTCG 12 and box T730 on page TTCG13 of the. The estate income tax return must be filed by April 15 2022 for a December 31 2021 year end or the 15th day of the fourth month after end of the fiscal year.

Form M706 Estate Tax Return and payment are due nine months after a decedents death. The income deductions gains losses etc. For calendar-year file on or before April 15 Forms.

Since this date falls on a holiday this year the deadline for filing Form 1041 is Monday April 18 2022. 10 rows Estate Tax Return for decedents dying after December 31 2020 and before January 1 2022. 13 rows Only about one in twelve estate income tax returns are due on April 15.

Income Tax Return for Estates and Trusts. If tax is due the tax. This 2021 is Thursday but the deadline can sometimes be.

What is the due date for fiduciary income tax returns. Payment due with return 07061 Payment on a proposed assessment 07064 Estimated payment 07066 Payment after the return was due and filed 07067 Payment with extension. We allow an automatic six-month extension to file but do not allow an extension for payment.

The 2021 rates and brackets were announced by the IRS here What is the form for filing estate tax return. The form and notes have been added for tax year 2020 to 2021. File an amended return for the estate or trust.

If the section 645 election hasnt been made by the time the QRTs first income tax return would. Small to mid-sized taxpayers will have a one-time election to continue using property and payroll to apportion income in tax years beginning on or after January 1 2018. The Tax Law requires a New York Qualified Terminable Interest Property QTIP election be made directly on a New York estate tax return for decedents dying on or after April 1 2019.

All tax refunds including the 62F refunds are taxable at the federal level only to the extent that an individual claimed itemized deductions on their fedreal return for tax year 2021. Deadline for filing a 2021 calendar-year C corporation or calendar-year estatestrusts tax return.

Estate Tax Returns Estate Planning Estate Settlement The American College Of Trust And Estate Counsel

Due Dates Department Of Taxation

:max_bytes(150000):strip_icc()/1040-NR2021-59bde80441114cfa9cb43d182e899b8b.jpeg)

Form 1040 Nr U S Nonresident Alien Income Tax Return Definition

State Income Tax Extensions Weaver

Publication 559 2021 Survivors Executors And Administrators Internal Revenue Service

Tax Deadline Extension What Is And Isn T Extended Smartasset

A Guide To The Federal Estate Tax For 2022 And 2023 Smartasset

When Are Taxes Due Tax Deadlines For 2022 Bankrate

Irs Form 1041 Filing Guide Us Income Tax Return For Estates Trusts

:max_bytes(150000):strip_icc()/184283932-56a044915f9b58eba4af9970.jpg)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

Irs Form 1041 Filing Guide Us Income Tax Return For Estates Trusts

Prepare And Efile A 2022 2023 Maryland State Income Tax Return

2021 Taxes 8 Things To Know Now Charles Schwab

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

How To File An Irs Tax Amendment Via Form 1040 X Online

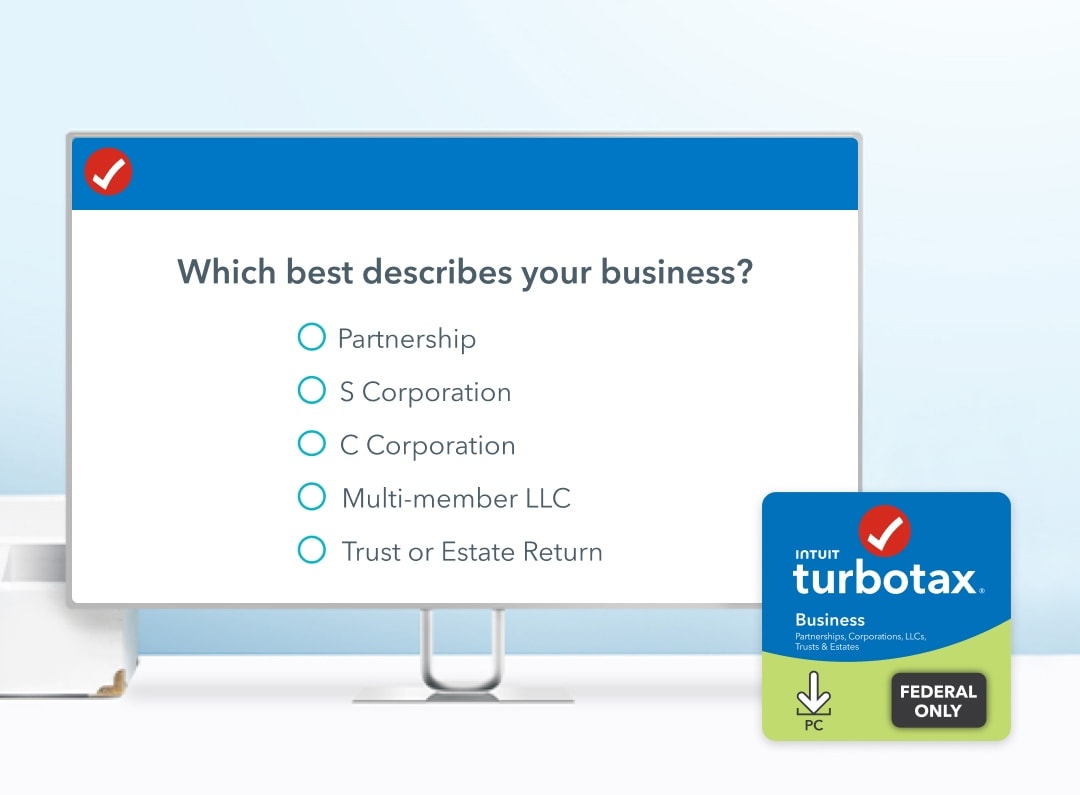

Turbotax Business Cd Download 2022 2023 Desktop Business Tax Software

:max_bytes(150000):strip_icc()/IRSForm1310-ed524d9fd5f24019a95dee03140c5ac2.jpg)